Farmer Friendly Finance

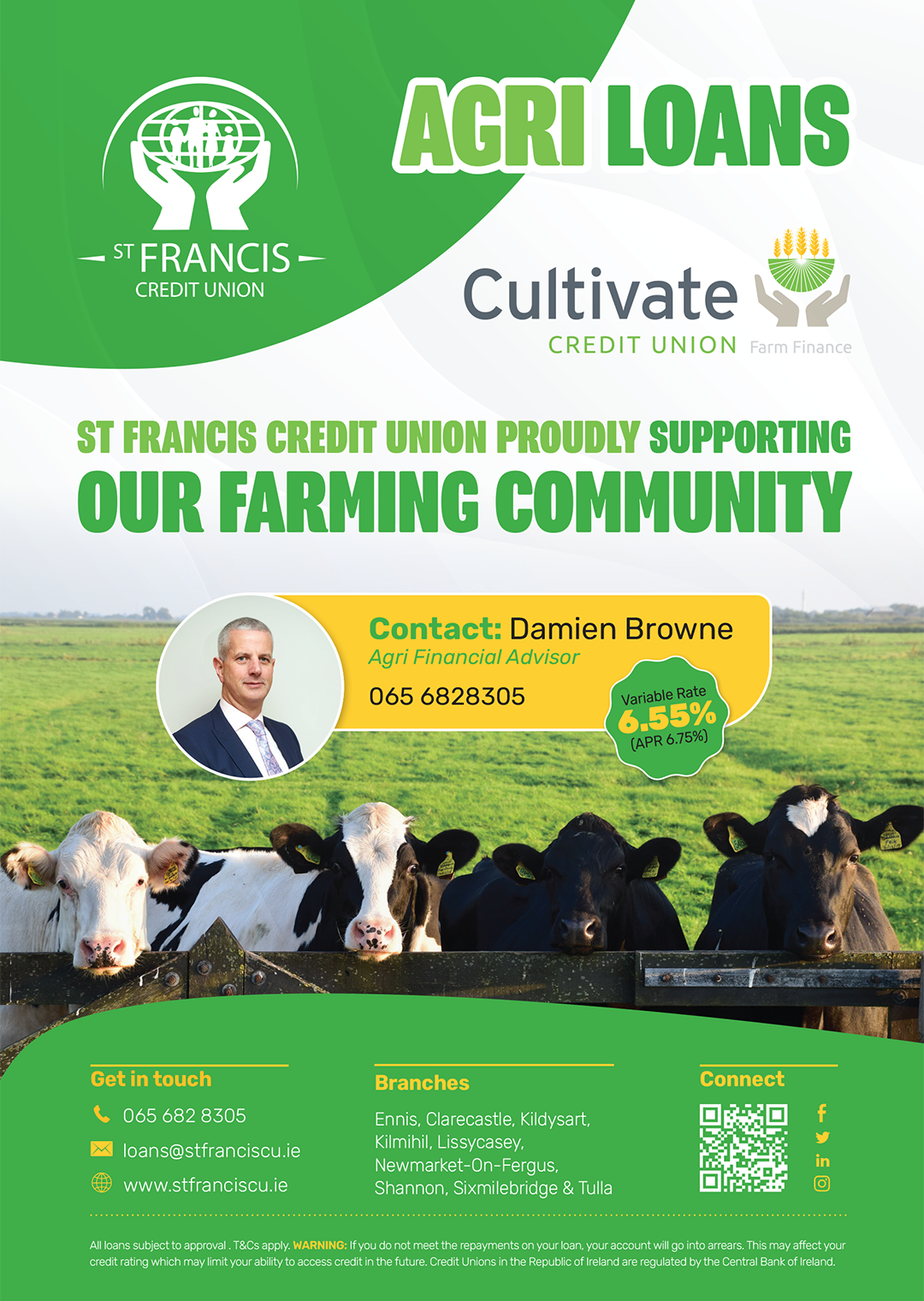

Cultivate is one of our newest lending products that enables us to help our farming members develop and future proof their business by providing quick and easy access to finance.

Cultivate is an initiative of a group of Credit Unions that provides short to medium term loan opportunities built specifically around the growing needs of our farming members.

Borrow up to €75,000 for up to 7 years at a variable interest rate of 6.55% variable, typical APR 6.75%.

Farmers can call the office and talk directly to a local person if they have a query – all decisions are made in-house.

Please refer to our SME lending page for further information on lending regulations

Agri Loan Features

Supporting Documentation

What documents are required for a loan application?

Outgoings

Proof of Income

Photo ID

Loan Application Process

1. Become a Member

Once you are living or working within our common bond you are eligible to join us today and start borrowing.

2. Calculate your Loan

Estimate how much you could borrow and calculate your repayments: weekly, fortnightly or monthly using our online calculator.

3. Apply for Loan

Apply for your loan from the comfort of your home or in one of our 9 offices. Applying for a loan is easy and quick. Apply now!

4. Sit back and relax!

The decisions are made quickly on loan applications, usually within 24 hours.

Agri Loan – 6.55% variable (6.75% typical APR)

Representative Example

A 5 year Cultivate Loan of €30,000 will have 260 weekly repayments of €135.15, Interest 6.55% variable, (6.75% APR). If the APR does not vary during the term of the loan the total cost of credit is €5,138.64. The total amount payable is €35,138.64.

How to Apply?

Online

The fastest way to apply is on our Mobile App or via your Online Account.

Call Us

Call us during office hours on

065 6828305.

Email Us

Send an email with your loan details to us at loans@stfranciscu.ie.

Visit Us

Call into any of our 9 offices in Clare with all your required documentation.